Manufacturers in Michigan offering $20 per hour deserve recognition for reaching this important milestone, especially considering the steady wage growth seen post pandemic. It’s understandable that businesses face constraints, and for many operations, paying significantly above this rate can feel economically unfeasible. Yet, the data from the most recent ALICE (Asset Limited, Income Constrained, Employed) report reveals a critical truth: even at $20 per hour, employees may only be scraping by, if at all.

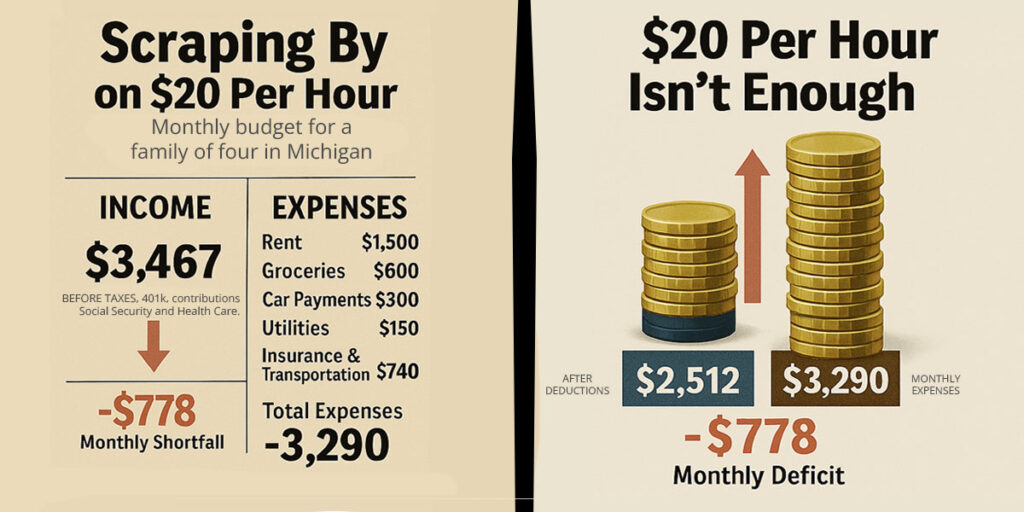

Let’s briefly review what “scraping by” really looks like for a typical family of four in Michigan. A full-time worker at $20 per hour earns approximately $41,600 annually, or about $3,467 per month before taxes. Once we deduct basic monthly expenses such as rent for a modest two-bedroom apartment ($1,500), groceries ($600), car payments, utilities ($150), insurance, and essential transportation costs, the monthly expenses quickly climb. Even assuming a highly conservative and somewhat improbable scenario such as a modest $300 monthly payment on a reliable used car, total expenses still rise to about $3,290. This isn’t extravagant living; it’s cautious budgeting at every turn.

However, when typical payroll deductions and healthcare premiums (averaging $536 monthly pre tax) are factored in, net monthly income drops significantly to around $2,512 per month. Suddenly, families find themselves consistently short by roughly $778 each month. Over the course of a year, this adds up to nearly $9,336 in financial shortfall. This gap isn’t just stressful, it’s economically dangerous, pushing households closer to financial crisis every month.

Now consider employers paying below this $20 per hour threshold. Their workers undoubtedly face even harsher realities, struggling daily to meet basic needs like food, rent, and childcare.

According to the latest Michigan ALICE report, the financial strain on families has reached alarming levels:

- In 2023, approximately 41% of Michigan households (1.6 million families) fell below the ALICE threshold. This includes 14% living in outright poverty and another 27% working but unable to consistently afford basic essentials.

- A single adult in Michigan now requires at least $28,740 annually to meet basic needs. For a family of four, this figure balloons to $74,556, dramatically outpacing the outdated federal poverty standard of about $30,000 and also significantly above the $41,600 the employee makes in a year.

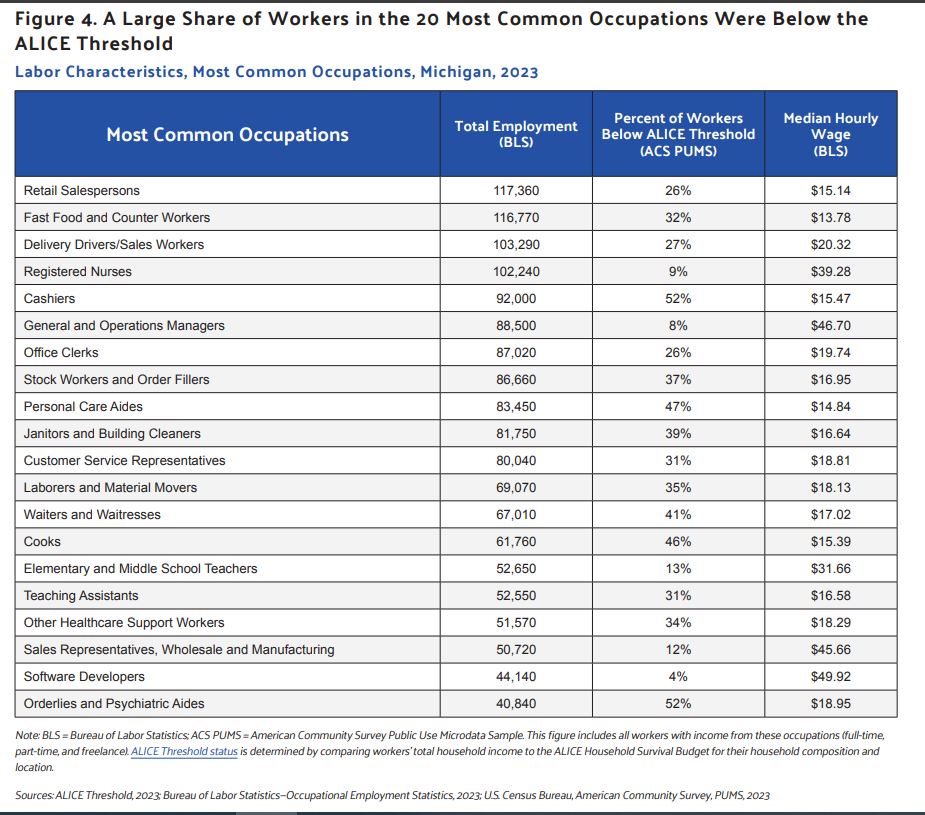

- Alarmingly, 14 out of Michigan’s top 20 most common jobs pay below $20 per hour, directly contributing to the rapid increase of ALICE households, which rose 18% between 2010 and 2023 alone.

- Systemic inequalities persist: nearly 62% of Black households and 75% of single female headed households with children fall below the ALICE threshold, highlighting the urgency of wage and policy reforms to address these disparities.

For manufacturers in Michigan, navigating these economic waters isn’t straightforward. Tight profit margins, global competition, and increasing operational costs in a trade war, make substantial wage increases challenging. However, ignoring the reality faced by workers isn’t just an ethical concern, it’s an operational imperative. Employees facing ongoing financial stress exhibit higher absenteeism, reduced productivity, and elevated turnover rates, resulting in costly disruptions that significantly impact efficiency and profitability.

Here’s a practical checklist for Michigan manufacturers looking to balance fiscal realities with responsible employee support:

-

Assess Wage Levels: Regularly benchmark wages against updated living cost figures. Even incremental adjustments can significantly alleviate employee hardship.

-

Utilize ALICE Mapping: Leverage tools to identify financial hardship hotspots within your workforce, enabling targeted, efficient interventions.

-

Introduce Targeted Benefits: Consider low cost but impactful programs like childcare assistance, transportation stipends, or matched emergency savings accounts.

-

Flexible Scheduling: Offer flexible scheduling options to reduce commuting costs and childcare burdens, immediately enhancing employees’ financial stability.

-

Community Partnerships: Build alliances with local nonprofits and community groups specializing in affordable housing, healthcare, and daycare solutions, multiplying the impact of your efforts.

-

Promote Financial Literacy: Facilitate workshops on personal budgeting, debt management, and financial planning, empowering employees with knowledge and resources.

-

Transparency and Communication: Clearly communicate your wage structure, constraints, and plans, fostering trust and collective understanding among employees.

Employers proactively addressing their workforce’s financial realities create a positive feedback loop, leading to enhanced employee engagement, lower turnover, and increased productivity, key competitive advantages in a tight labor market.

Ultimately, Michigan manufacturers face a delicate balancing act. While paying $20 per hour is commendable and demonstrates meaningful progress, it’s essential to acknowledge that employees at this wage are still vulnerable to significant financial hardship. By thoughtfully implementing targeted strategies and support mechanisms, employers not only strengthen their workforce but position themselves as leaders in Michigan’s economic growth and community stability.