It’s been a long war for employers. Of course, ‘war’ isn’t the best word to use when it comes to how employers are dealing with employee demands. But since the Great Resignation, Quiet Quitting, Work From Home, and other new phrases worked their way into the labor market post-pandemic, it probably feels like a war for HR professionals who’ve been on the front lines of keeping their own businesses operationally staffed.

There were a lot of concessions made by employers, and right now it seems like a relative time of peace in the labor market as wages have caught up to inflation. The new workplace norms such as the embrace of remote work, the implementation of higher wages, and the cultivation of a positive work culture have been pivotal. More importantly, valuing employee input has not only boosted morale but also enhanced productivity. These changes have been a beacon of progress in the ever-evolving landscape of employment.

However, as we stick our toe into the frigid water of January 2024, the dynamic is shifting once again. The labor force is increasingly populated by a younger demographic, bringing new expectations and values into the workplace. Employers who wish to continue their trajectory of success must be agile and responsive to these evolving needs.

One of the primary concerns for employees today is financial stability. The most critical and existential issue facing your workforce is something that those in the ‘decision-making rooms’ may not identify with at all: housing.

The American dream of homeownership is becoming increasingly important for Generation Z and for the youngest Millennials who are trying to keep up with their own generation’s growth. As this dream slips further away for young people due to the extreme lack of housing construction, employers who factor the cost of housing into their compensation strategies are likely to attract and retain a more dedicated and longer-tenured workforce. By aligning salaries with the reality of housing costs, employers not only aid in financial stability but also demonstrate a deep understanding and commitment to the holistic well-being of their employees. This approach can lead to a more engaged and loyal workforce, essential in the competitive job market of 2024.

As of late 2023, the average home value in Michigan is approximately $233,858, with a median sale price around $239,000. This reflects a moderate increase in home prices over the past year. To understand how these housing costs relate to affordability, we need to consider the average mortgage payment and compare it to the average wage in Michigan.

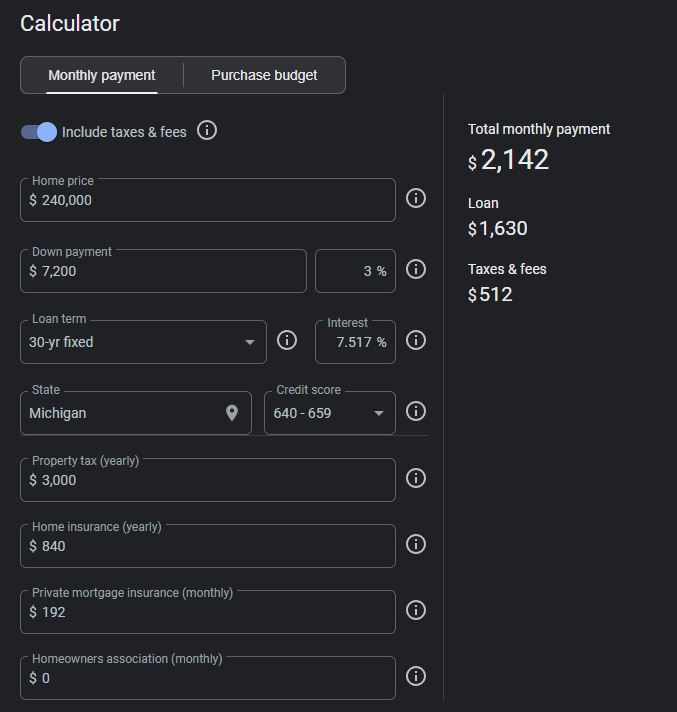

Realize that young people aren’t going to be able to throw down $48,000 on a 20% down payment and are more likely to be somewhere around 3% for an FHA mortgage. A mortgage on a $240,000 home at current interest rates with a decent 670 credit score (the lowest number to be considered GOOD credit) with property taxes, PMI, and insurance comes to a monthly payment of $2142. That means that according to the 30% rule, a family would have to have a monthly income of $7,140. This is the part where reality hits your employees in the face. In order to afford an average Michigan home, a family would need to bring in $85,000 or more a year.

According to the U.S. Bureau of Labor Statistics, the average annual wage in Michigan in 2024 is $58,367, or about $4,800 per month before taxes. The average home price and estimated mortgage payments may exceed what is considered affordable for many residents based on the 30% income rule. This disparity highlights the growing challenge of homeownership for many, particularly for younger generations like Gen Z, who are entering the housing market under these economic conditions.

Let that sink in. What if both parents in the home work to help make that number? Great idea! But who’s covering childcare costs? Average daycare rates in Michigan are over $11,500 per year. Add that to the housing costs and any idea of getting married, buying a home, and building a family is reserved for six-figure incomes only.

That is beyond daunting for young people who are averaging between $20-$30 per hour in their young careers. It’s already leading experts to predict disastrous results for society. As younger generations lose hope at the starting line, it’s no wonder they are not emotionally connected to their employer. They are in survival mode and feel as if the people who could help them, simply won’t in the name of expanded profits for the quarter.

Actionable Steps for Employers to Support Their Workforce

Free Initiatives to Foster a Supportive Environment: Promote Financial Literacy and Planning: Offer workshops and resources on financial literacy, budgeting, and planning to help employees manage their income and prepare for future financial stability.

Implement a Transparent Salary Review Process: Maintain transparency in compensation. Regularly review and communicate the rationale behind salary structures to build trust and demonstrate commitment to employees’ financial health.

Create a Supportive Company Culture: Encourage open discussions about challenges, including housing and financial concerns. This fosters a sense of community and support within the organization.

Financial Strategies to Address Housing Challenges: Consider Housing Stipends or Assistance Programs: Offer housing stipends or partner with local real estate entities to provide affordable housing options.

Reevaluate Compensation Packages: Regularly assess and adjust salaries to align with the cost of living and housing prices, even if it requires a more significant financial investment from the company.

Fostering Open Dialogue and Ongoing Support: The foundation of any successful initiative is open dialogue and ongoing support. Regular communication between management and employees is essential to understand and act on their concerns. By fostering an environment of support and understanding, employers can build a more loyal, productive, and satisfied workforce. Empathy goes a long way with employees.

As employers, adapting and responding to these challenges is not only beneficial for employees but also an investment in the company’s future. A workforce that feels supported and understood is more likely to be engaged and committed, leading to mutual growth and success. Meeting them financially will be a developing challenge, but helping them simply live and have a chance should be a ‘North Star” for employers for the next several years.