Your business can create a simple act of kindness that benefits the community and helps your brand build goodwill. Corporate philanthropy is the act of a corporation or business promoting the welfare of others, generally through charitable donations of funds or time. Donating to nonprofits helps the charity of course, but the impacts of giving to charity and how it helps your community and your business are invaluable.

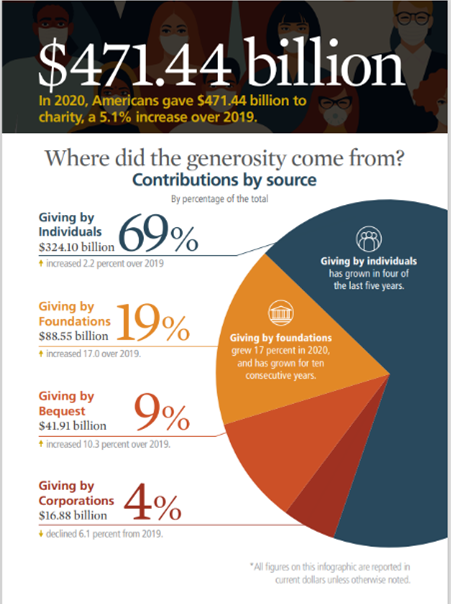

Sadly, contributions by U.S. companies fell 6.1% in 2020 to $16.66 Billion (a decline of 7.3% when adjusted for inflation) during the pandemic, while individual donations increased. This is largely blamed on the economics of the pandemic in 2020, as personal savings rates skyrocketed, while corporate profits were down 5.1% in 2020.

On average, corporations donate less than 1% of their profits to charity. American Express and The Chronicle of Philanthropy recently conducted a study that found small companies donate an average of 6% of their profits each year. American households donated 2-3% of their income to charities over the same period. Many would like to see corporations increase their donations to match what the typical American gives each year.

WHY DOES MY BUSINESS NEED TO STEP UP?

A study from the Chronicle of Philanthropy says declining levels of trust among Americans for most institutions and each other may also contribute to the move away from charitable giving. Most of the distrust lies along the same division lines in American society today. That mistrust is especially pronounced among Gen-Z and millennials, which could cause another layer of challenges for charitable organizations. An example of this would be Saint Jude’s Children’s Research Hospital, which raised $2 billion in 2020, making it the third most contributed charity in the United States. Yet, only half of what St. Jude raised over the last five years went to research or patient care. Thirty percent went to cover fundraising costs. Allocations like these cast doubt in donors’ minds about the true impact of their gift.

How much money Americans make also plays into the reduction in charitable donations. Four out of five households with an income of $200,000 or more contributed to a nonprofit. On the opposite end of the spectrum, less than three in five households with an income of $50,000 made a charitable donation in 2020.

In addition to helping fill in the gaps for your local nonprofits, there are other benefits for your business including building goodwill in your local community, improving the morale and company culture of your organization, promoting charities that match your values as a company, and building up your network.

WHERE DO I START WITH CHARITABLE GIVING?

Volunteer: Instead of a monetary donation, companies can donate their time to a great cause. Volunteer as a company at a soup kitchen, charity run or homeless shelter. With volunteer support initiatives, companies partner their employees with nonprofits to provide specialized support only that company can provide.

Sponsor a sports team: Youth organizations are always looking for businesses to sponsor their teams. Donate funds towards field upkeep and uniforms. Companies that sponsor teams can have their names displayed on uniforms or field signs.

Launch a charity drive: Start a collection for a particular cause. Your company can collect non-perishable food items for distribution at food banks. Toy drives are popular around the holidays.

Technical Assistance: Do you operate with professionals who could donate their skills and time to help non profit organizations get a leg up on technology, web and IT services, or graphic design. You can’t claim this as a deduction, but it’s an invaluable donation to many groups.

Donate online: Set up automatic donations through virtual giving platforms. Donors that set up some sort of recurring monthly donation give 42% more than one-time givers, claims Nonprofit Source. You could even leave out a collection jar at your place of business and cash in the collected amount to send through an online portal.

Create A Giving Culture: Collective participation in philanthropy engages employees with each other. Companies with engaged employees who enjoy their jobs outperform companies with disengaged workers by up to 202%! You can match employee contributions to their favorite charities. Employee grant stipends are also a way to not only encourage giving, but to create an added benefit to employees and their well being. An example is The Coca-Cola Company, which offers a $20,000 employee matching opportunity, and Walmart, who provides $250 to employees for 25 volunteer hours.

WHAT CAN I DEDUCT?

Studies show that donating to nonprofit organizations just to get a tax break are few and far between. Business deductions for charitable contributions may be limited, and the deductions may only be deductible for the individual owners rather than the business itself. Every business type, with the exception of traditional C corporations, pays taxes as a “pass-through” entity. This means the business’s taxes are passed along to the company’s individual owners.

The IRS website reads, “In general, contributions to charitable organizations may be deducted up to 50% of adjusted gross income computed without regard to net operating loss carrybacks.” New laws now permit C corporations to apply an increased corporate limit of 25% of taxable income for charitable cash contributions made to eligible charities during calendar year 2021. The increased limit is not automatic. C corporations must choose the increased corporate limit on a contribution-by-contribution basis.

It’s important to start by verifying whether you can claim a deduction for a donation to a charity. In order to claim as a deduction, only donations to 501(c)(3) organizations qualify, and a donation to an individual person or any other 501(c) designated non-profit is typically not tax-deductible.

If donating to a new charity this year, be sure to ask to see the business’s letter from the IRS that designates them as a tax-exempt organization. You can also search using the IRS Exempt Organizations Select Check online tool to verify whether the charity is or is not eligible for a deduction.

Don’t make it so that you’re donating to receive a benefit of any type (e.g.. donations to a raffle don’t qualify because you could win a prize in return). As mentioned above, you can’t create a donation based on time and services provided and your meal and entertainment expenses don’t qualify.

You can only deduct mileage if you were not traveling to the destination for any other reason. You cannot deduct your time or the time of your employees who are volunteering for a charitable organization. Gifts and/or donations to political parties, organizations, candidates, or particular individuals, are not recognized as tax-deductible by the IRS.

Do not take this as professional tax advice. It’s not a bad idea to speak with financial experts for advice on how to donate to charity in a way that makes sense for your business.