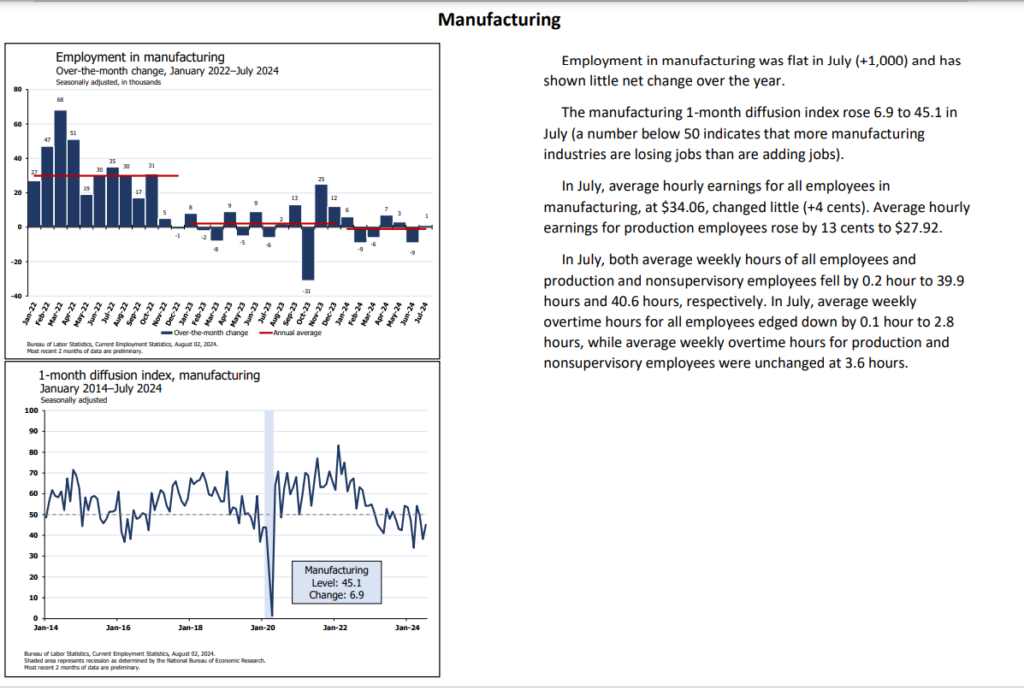

If 2024 has taught us anything, it’s that the economy is like a rollercoaster you never quite signed up for. Earlier this month, we had a less-than-stellar jobs report—cue the collective sigh of disappointment. The U.S. economy added fewer jobs than expected, falling short of projections and rattling market confidence. For a moment, it felt like the rug was being pulled out from under us again, especially for the manufacturing sector, which has been caught in a downward spiral for most of the year.

Early August Panic and Sudden Recovery

In the days following the jobs report, the market had a brief but intense panic attack, reminiscent of the wild whipsaw reactions we’ve become accustomed to in recent years. The Dow took a dive, dragging spirits down with it. Analysts began sounding the alarm, predicting that the economy was losing steam faster than anticipated. Manufacturing, already battered by supply chain woes and fluctuating costs, braced for another blow as hiring seemed destined for the slow lane.

But just as we were buckling up for more turbulence, the narrative flipped. Inflation data started showing a much-needed cool-down, and suddenly, the Fed’s iron-fisted grip on interest rates seemed ready to loosen. The markets, always fickle, reversed course, with stocks rebounding almost as quickly as they had fallen. The prospect of a Fed rate cut in September emerged, injecting a dose of optimism into an economy that had seemed on the brink just days earlier.

The Tug-of-War on Manufacturing Jobs

For the manufacturing sector, these back-and-forth waves have been particularly jarring. On one hand, the disappointing jobs report raised fears of continued layoffs and a tightening labor market. On the other, the improving economic indicators like cooling inflation and strong retail performance from giants like Walmart offer a glimmer of hope. Could this finally be the turn manufacturing has been waiting for?

There’s a case to be made for cautious optimism. If the Fed does cut rates in September, manufacturers could see lower borrowing costs, which might prompt some to invest in growth and, by extension, jobs. Stable input costs, driven by cooling inflation, would also provide much-needed relief. But let’s not break out the champagne just yet. The sector is still licking its wounds from earlier in the year, and hiring might remain conservative until there’s more certainty that this recovery isn’t just another false dawn.

Navigating the Mixed Signals

The economy’s current state is like a rickety bridge, wobbling under the weight of mixed signals. For every piece of good news, like the potential for a Fed rate cut, there’s a reminder of the fragility that still exists, such as the weak jobs report. Manufacturing, as always, is caught in the middle. The sector’s recovery will likely be slow and uneven, with businesses cautious about adding to their workforce until they see sustained signs of stability.

In the meantime, manufacturing workers and employers alike will need to stay agile, navigating these unpredictable waters with a mix of hope and pragmatism. The economy may be sending out mixed signals, but one thing is clear: the ride is far from over.