The Detroit Regional Chamber’s September 2025 Michigan Statewide Voter Survey, conducted by the Glengariff Group, offers a snapshot of a state both resilient and restless. The data reveal a public that sees signs of economic stabilization but remains haunted by high costs, uneven opportunity, and deep uncertainty about what lies ahead. Over the next six months, the outlook hinges on whether consumer confidence and job quality can overcome the drag of inflation and tariff pressure.

Michigan’s Mood: A Narrow Majority Feels the State is on Track

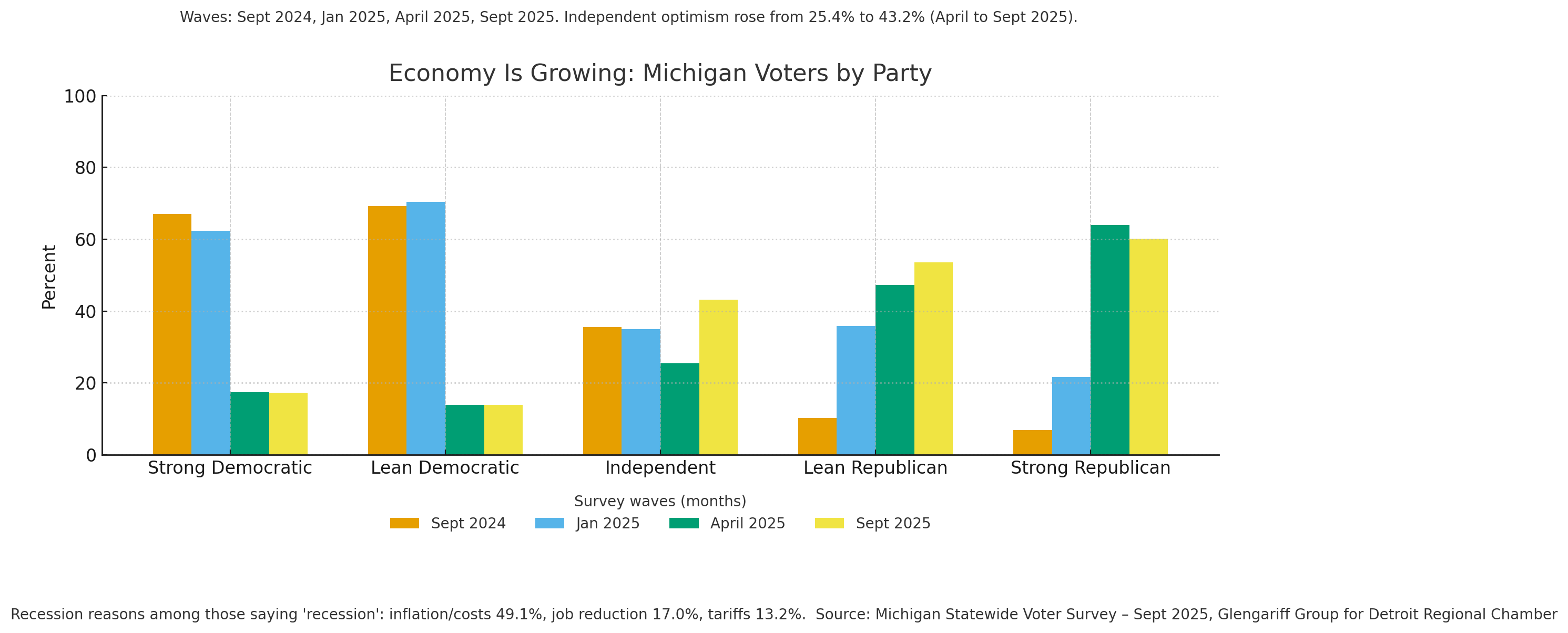

For the first time since early 2025, more than half of Michigan voters, 51.5 percent, say the state is on the right track, compared to 33.7 percent who believe it is on the wrong one. This modest optimism stems mainly from independents, whose right-track sentiment jumped from 44.7 percent in April to 52.3 percent in September. Strong Republican voters also showed a notable uptick, from 20.9 percent to 34.0 percent. These shifts suggest a fragile coalition of confidence that extends beyond partisan lines, even as economic doubts persist.

But when asked specifically about the economy, Michiganders are divided. Forty-two point four percent say it is on the right track, and 42.8 percent say it is not. This statistical split highlights a state where people may feel better about direction and leadership than about their wallets.

Political identity shapes how people read the same economic facts. This is normal and well documented. Pew shows that views of national economic conditions swing with party control of the White House, with Republicans turning more positive and Democrats more negative in 2025. Gallup reports the same flip in its Economic Confidence Index following the 2024 election, driven by Republicans becoming more upbeat and Democrats more downbeat. Political scientists describe this as motivated reasoning or partisan bias in perception, where people seek and interpret information that affirms prior loyalties rather than updating neutrally.

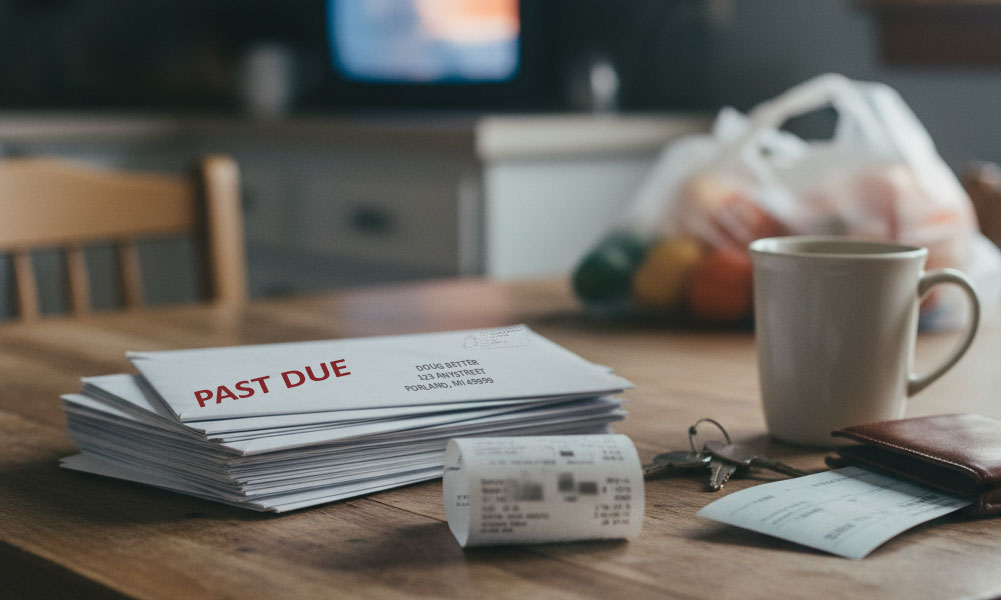

Inflation: The Persistent Undercurrent

Inflation remains the state’s defining economic anxiety. Among voters who say Michigan’s economy is on the wrong track, 38.8 percent cite inflation and the cost of goods as the main reason, up sharply from 22.9 percent in May. Three out of four residents, 75.8 percent, report paying more for groceries, two thirds, 68.1 percent, for utilities, and 60.4 percent for home or auto insurance. These figures cut across demographics and party lines.

The pain of rising costs has not translated into universal despair. Roughly 72.6 percent of voters say they are doing better or about the same as a year ago. Yet, of the 27.1 percent who say they are doing worse, a majority, 55.2 percent, blame inflation. Only 16.8 percent say they are doing better, often due to wage increases, promotions, or new jobs, small but meaningful signs of labor-market movement.

Jobs and Hiring: The Confidence Gap

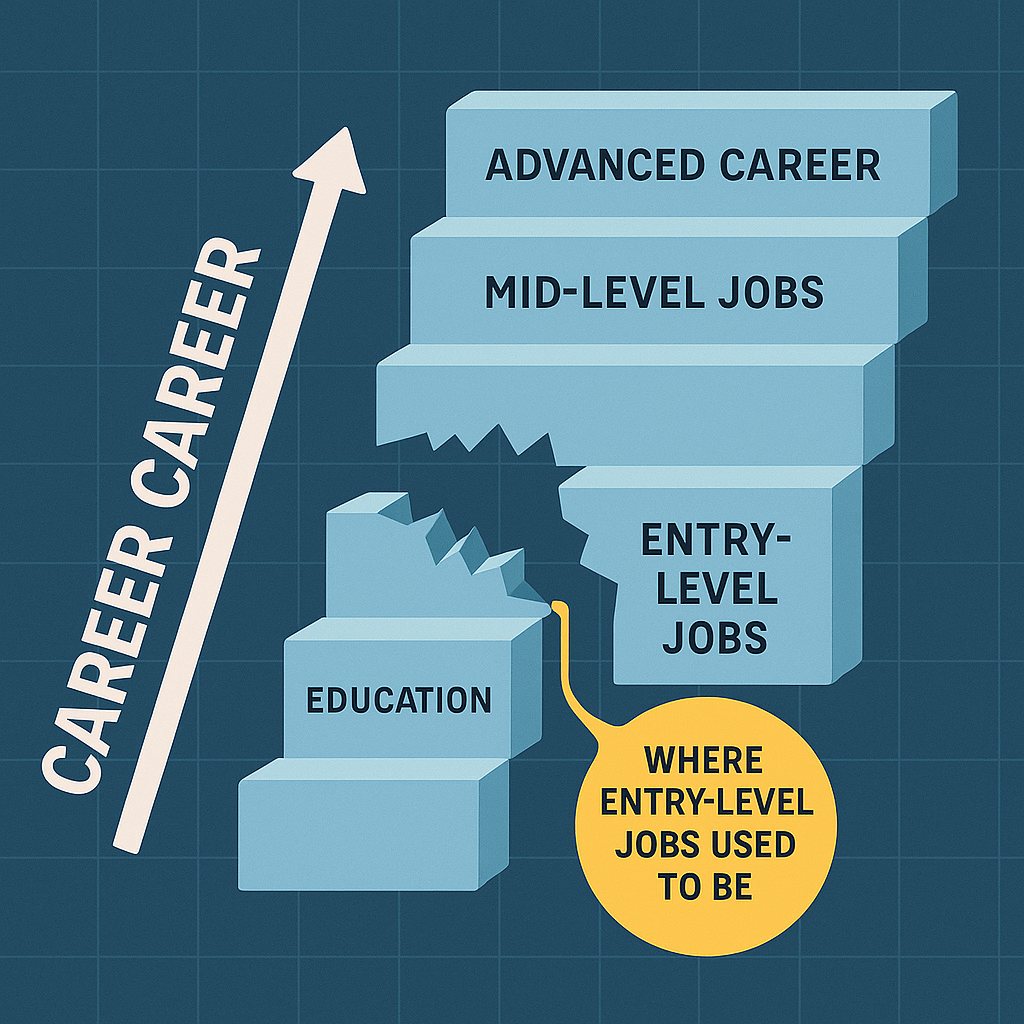

Just over half, 52.0 percent, believe good-paying jobs are available, a drop of eight points since May. That decline is led by Democratic voters, only about one third of whom see strong job prospects. Independents, 60.4 percent, and Republicans, roughly two thirds, are more upbeat. Still, four in ten Michiganders say they know someone looking for work, and 77.8 percent of them say it has been hard to find a job. Among those aware of recent college graduates, 77.0 percent say the same.

This sentiment gap, between perceived availability of good jobs and personal experience finding them, underscores a labor market that feels tight on both sides. For employers, it signals lingering competition for skilled workers even as wage pressure softens. For job seekers, especially younger and lower-income workers, it reflects frustration that openings do not always translate into sustainable pay.

Tariffs: A Clear Economic Flashpoint

Michigan’s manufacturing base feels the bite of global policy more than most. Voters oppose the expanded tariffs by a 51.2 to 40.8 margin. A majority, 71.5 percent, say tariffs have increased what they pay for goods, and 60.3 percent believe tariffs are hurting the state’s auto industry. Nearly half expect smaller profit-sharing checks for auto workers this year.

Those numbers suggest that what was once an abstract policy debate has become a daily reality for Michigan households. The rising costs of vehicles, materials, and inputs are trickling through to local economies. Yet, some blue-collar workers remain more supportive of tariffs than their white-collar counterparts, indicating that the political divide over trade is tied to identity as well as economics.

Artificial Intelligence: A Dividing Line Between Opportunity and Anxiety

Nearly half of Michigan voters (47.5%) report using AI in their personal or professional lives, but optimism about its benefits is muted. Only 23.7% believe AI will make Michigan more prosperous, while 39.4% think it will make the state less so. A majority (61.0%) expect AI to lead to fewer jobs, not more Fall-2025-Michigan-Voter-Poll . The divide between white-collar and blue-collar voters is striking: 71.6% of white-collar workers say they use AI, compared to just 36.6% of blue-collar workers. This gap reveals an emerging structural challenge: whether technology adoption will widen or bridge economic divides. If Michigan’s industrial base fails to reskill its workforce at pace with automation, that pessimism could become self-fulfilling.

The Next Six Months: Two Diverging Roads

Optimistic scenario: Inflation continues to cool, tariffs stabilize, and employers—especially in automotive and advanced manufacturing—resume hiring to meet long-term production goals. Wage growth steadies, confidence rises among independents, and consumer spending normalizes into early 2026. Negative scenario: Inflation expectations, already high (43.1% expect it to worsen), drag on real wages. Tariff-driven costs ripple through Michigan’s manufacturing base, curbing output and dampening profit-sharing. Job openings persist, but workers remain mismatched or underpaid. In that climate, optimism could collapse as quickly as it rebounded. The September 2025 survey captures a moment of balance—between endurance and fatigue, adaptation and anxiety. Whether Michigan leans toward renewal or retrenchment will depend less on macroeconomic forces and more on how effectively its employers, educators, and policymakers convert short-term strain into long-term resilience.