As the upcoming election draws near, the revitalization of American manufacturing has once again become a central theme in political discourse. Presidential candidates are making ambitious promises to bring back factory jobs and strengthen the industry. However, for manufacturing professionals in Michigan—a state with a rich industrial heritage—the pressing question is: How much can a president truly influence the revival of manufacturing, and what local opportunities are shaping the industry’s future? This recent New York Times article asked that question. In this blog, we examine how the election could affect jobs here in Michigan.

Political Proposals vs. Economic Realities

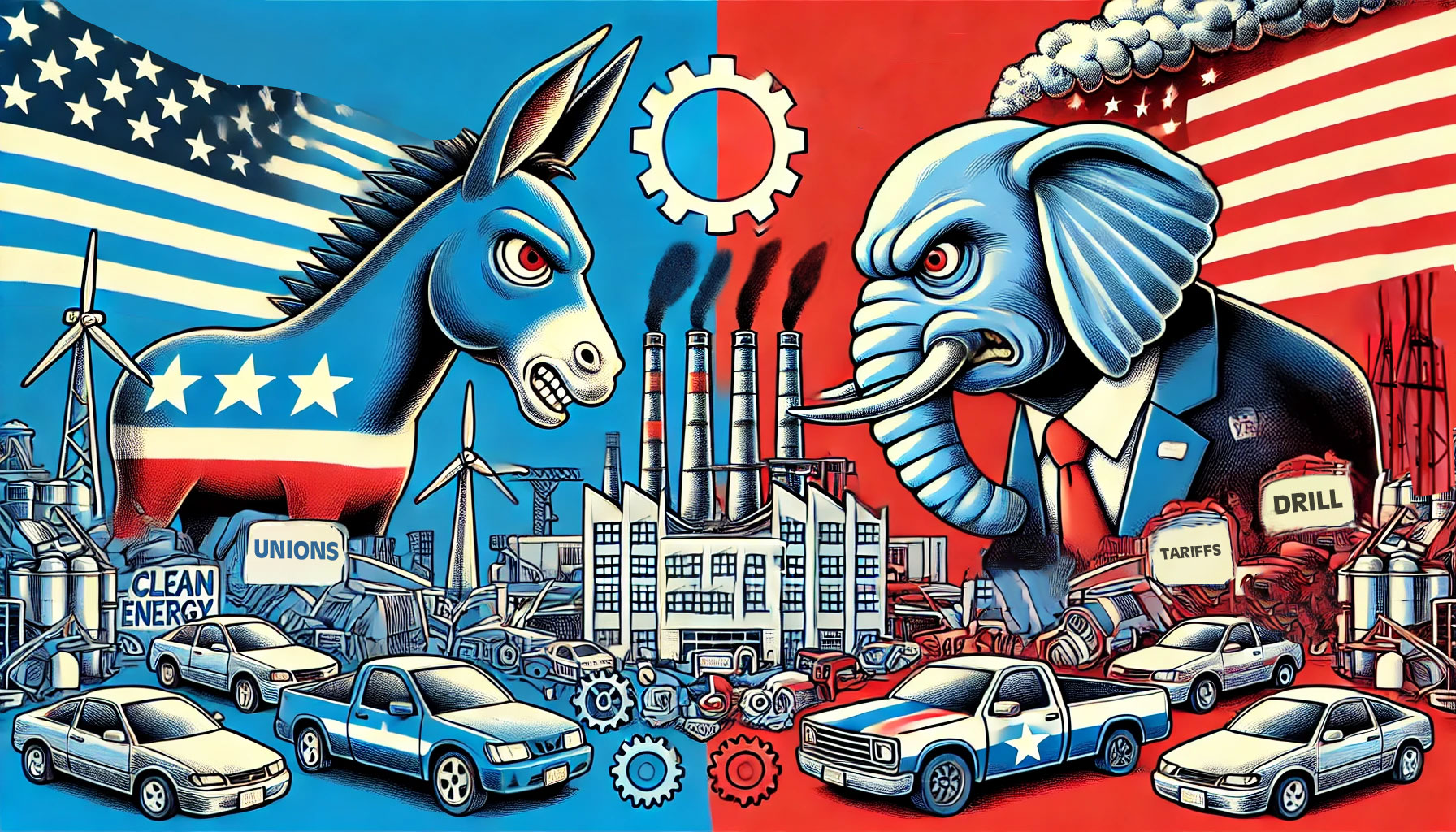

Former President Donald J. Trump proposes imposing hefty tariffs on nearly all imports to encourage foreign companies to produce goods in the United States. Vice President Kamala Harris, meanwhile, advocates for tax credits and expanded apprenticeships to bolster factory towns and invest in advanced technologies. While these proposals make for compelling campaign narratives, historical evidence suggests that no president can single-handedly dictate the growth of specific industries.

Economic forces such as global market trends, technological advancements, and exchange rates often have a more significant impact on manufacturing. While federal policies can provide incentives and create a favorable environment, the real drivers of manufacturing growth are often found at the state and local levels.

Sun Belt States: The Rise of Business-Friendly Environments

In recent years, manufacturing jobs have been migrating toward the Sun Belt states—such as Texas, Florida, and those in the Southeast—known for their business-friendly climates. These states offer lower taxes, fewer regulations, reliable access to power, and a growing workforce attracted by a lower cost of living and favorable weather.

Nevada, for example, has seen its manufacturing job base grow by more than 13% from early 2020 to March 2023. The state has actively worked to diversify its economy beyond hospitality and entertainment, offering incentives and a welcoming atmosphere for manufacturers. Companies like Alliance North America (ANA) have relocated there, attracted by lower operational costs and a supportive business environment.

“Instead of companies choosing the right location based on all of their other requirements and the presumption that the workers are going to come to them, companies are starting from the presumption of, where are the people moving to?” said Didi Caldwell, president and CEO of Global Location Strategies.

Michigan’s Manufacturing Landscape: Leveraging Local Opportunities

Michigan offers a variety of subsidies and incentives designed to lure businesses and encourage expansion:

Michigan Business Development Program (MBDP): Provides grants, loans, and other economic assistance to businesses that create qualified new jobs and make new investments in Michigan.

Industrial Property Tax Abatement (PA 198): Offers property tax incentives to manufacturers looking to renovate or expand facilities, reducing costs associated with property improvements.

Michigan New Jobs Training Program (MNJTP): Assists employers in training workers for new positions by providing flexible funding to meet the demand for skilled labor.

Michigan Reconnect Program: Aims to help adults over the age of 25 earn a tuition-free associate degree or skilled trade certificate. This program enhances the workforce by providing manufacturers with a pool of skilled workers trained in advanced manufacturing techniques.

Good Jobs for Michigan Program: Provides incentives for businesses that create a significant number of high-paying jobs, aiming to boost the state’s economy and employment rates.

These programs underscore Michigan’s commitment to fostering a business-friendly environment, reducing operational costs, and supporting workforce development—a critical factor for manufacturers considering relocation or expansion.

Case Study: Michigan’s Attractiveness to Manufacturers

Several companies have taken advantage of Michigan’s incentives to grow their operations:

Ford Motor Company’s Electric Vehicle Investment: Ford has announced significant investments in Michigan to expand electric vehicle production, leveraging state incentives to modernize facilities and retrain workers.

LG Energy Solution’s Battery Plant Expansion: In Holland, Michigan, LG Energy Solution is expanding its battery manufacturing plant, supported by state grants and tax incentives aimed at boosting the clean energy sector.

These developments highlight Michigan’s strategic focus on not only preserving its manufacturing legacy but also pivoting towards emerging industries like electric vehicles and renewable energy technologies.

Balancing Local Advantages with National Trends

While the Sun Belt states offer attractive environments for manufacturers, Michigan’s unique combination of incentives, skilled workforce, and infrastructure continues to make it a compelling choice for manufacturing professionals.

Manufacturers in Michigan benefit from:

Skilled Workforce: Michigan boasts a rich pool of skilled labor, thanks to its strong educational institutions and programs like the Michigan Reconnect, which enhances workforce skills by providing tuition-free pathways for adults seeking degrees or certificates in high-demand fields.

Infrastructure and Logistics: The state’s robust transportation network—including major highways, railroads, and ports—facilitates efficient distribution and supply chain operations.

Community and Government Support: Local governments often work closely with businesses to streamline permitting processes and provide assistance, enhancing the ease of doing business.

Cautious Optimism Amid Uncertainty

Despite the positive local factors, the manufacturing industry remains cautious due to broader economic uncertainties and the impending election. Companies are mindful that the outcome could influence taxes, trade policies, and regulations.

“We’re a couple of months away from a huge decision point—who controls Congress and the White House,” said Timothy Fiore, manufacturing business committee chair at the Institute for Supply Management. “I think we’re kind of stuck here until the end of the year.”

Seizing Opportunities in Michigan While Recognizing National Trends

For manufacturing professionals in Michigan, the path to revitalization lies in leveraging state-specific incentives and opportunities while staying aware of national trends like the growth in Sun Belt states. While federal policies and political promises can influence the broader landscape, it’s the tangible, local actions that create a conducive environment for growth.

Michigan’s commitment to supporting manufacturing through various incentives, workforce development programs like Michigan Reconnect, and a business-friendly climate positions it as fertile ground for industry expansion. As the election nears, industry stakeholders should focus on these local advantages, ensuring they are well-positioned to capitalize on the opportunities ahead, regardless of political outcomes.